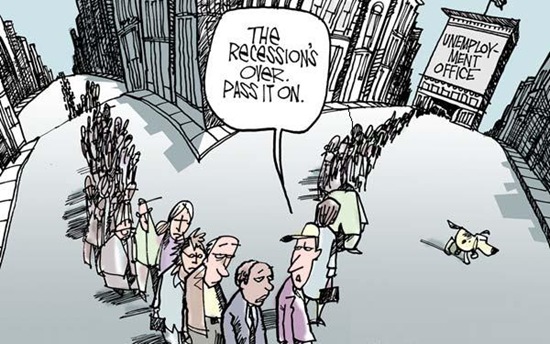

It’s been a while since we last looked at the economy and where its headed but I figured it may be a good time to get prepared for what economic changes winter will bring our way. There are three main points of focus that are on most people’s minds today. Unemployment, Elections and the Prime Rate are all key factors of our economic growth in 2011 but what needs to happen for us to get out of the recession’s aftermath?

Unemployment: This being the main reason people feel as thought the recession is still in full effect. Unemployment still lingering in the 9% mark remains high despite the end of the recession in June of 2009. When will this end? Well the bad news remains that its effects will be felt through most of 2011 and start dropping off in late 2011 as we face inflation. Don’t expect to go back to record lows of 2% for another 2-3 years. The private sector as well as government contracting will take its sweet time creating jobs as the uncertainty of another mini recession exists and caution is the game that most are playing, no matter how profitable their business are today. Winter always slows down the basic job market but opens much more temporary opportunities, as well as part time jobs in the retail fields. This slight boost might help a few folks as entry level jobs are those most impacted.

Elections: Senate and Presidential elections are right around the corner and this is great news for all of us. Most democratic parties will do their best to showcase they’ve done well on their words and therefore expect lower fuel prices over the winter, as well as the fed’s rate remaining low through mid 2011. Also expect much more media coverage on the national debt getting repaid by bank’s TARP money and the cost of living to be good until election time. If the Democrats continue to hold the Senate and The White House, you can expect the post recession effects to continue in a slower recovery. The good news is that this recovery will most likely be real despite being slow and not over inflated with creative ways to give a sense of wealth. It is much needed for this country to remain united in the same sense it has and allow democrats to continue their recovery plan. On the other hand if the Republicans win, the recovery efforts will once again be shifted and most likely benefit the wealthier groups first, which will not help our bottom end out of the hole its in.

The Fed’s Rate: This one has been on everyone’s minds for the past few months…With historical low rates, when will the FEDS raise the bar and start charging more for their money. Well, the answer is simple but the equation a bit harder. Technically to fight the upcoming inflation, they should raise it NOW… But to not hurt democrats chances and to ensure we have a pleasant winter, we most likely won’t see a rate jump until next summer, as the economy’s funds still needs to circulate better. Credit has loosen in the sense of money available to lend but most that qualify dont need it, meaning banks are looking for quality over quantity and are getting the financial backing they need by the FDIC and the FEDS to remain on the same course.

I actually think we are in for a treat as we head into the winter, despite all the road signs indicating that a harsh winter is upon us financially, I still believe that its another winter that will go by and its going to be much easier than last year. Construction has resumed in many parts of the US, and the retail industry is slowly improving, alongside car and home sales. I am one that might be optimistic but we need more positive than FEAR, and therefore I choose to see the better outcome of the road ahead.