The housing market is bad, the credit market is frozen, and your home is probably worth half of what it was 3 years ago. Let’s look at what has changed in the past year around refinancing rules and if it right for you.

In the past, many of us were allowed to buy homes for special $0 down programs, like the 80-20 or the 80-10-10 (80% first loan, 10% Line of credit and 10% down). These programs were meant to avoid paying Private Mortage Insurance (PMI) while putting 0 to 10% down. Well those days are over, most purchases require 10% down with PMI or 20% down. Who qualifies also changed as the credit markets froze over, 3 years ago a 680 credit score was considered golden, now 750 is considered good.These small changes have truly made it difficult for new home purchases which has left the home market down for the past two years. Since people are not buying the great homes we are selling, we are left with refinancing as our only option for some time but the rules have changed there too.

Most mortgage companies only allow you to go up to 90% of your home value, while only using your current value…which means you will most likely bring a nice amount of cash to the table at closing time.

Is refinancing the right option and what should you know?

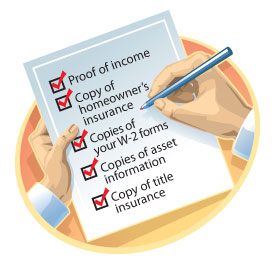

– Refinancing in this environment is going to be tough, you need a great credit score (720+) to get a good rate, you need to show good assets and income (you have to prove it, stated income days are gone), and you need to act fast as the value of your home might be lower at time of closing from the time you locked in your rate.

– You should consider refinancing only if you plan to stay in your home more than 5 years. It is expected that the economy will have fully recovered within the next 3-4 years and therefore it will be much easier to refinance in 4-5 years, and therefore the rates and terms will be more attractive as well.

– Refinances can be expensive. Most refinance loans will cost you between 1-3% of your home value in costs. If you keep your loan for more than 5 years, you might recoup some of those costs.

– The rates are not that attractive, they are not terrible but unless you have an immediate need for a loan, hold off a bit. The government promised to have a special program for main street included in their $700 billion bank bailout, they have not released details yet and therefore this might help free up credit markets or bring rates to a historical low.

– If your Adjustable Rate Mortgage (ARM) is adjusting, do NOT panic. It might work out in your favor, most ARM are based on the LIBOR (foreign bank rates) and at this point those have hit historical lows as we are in a global recession. If your rate adjusts for another year, then your payment might actually be lower than when you originally locked in in for its first cycle. Having an ARM is not bad, you simply need to understand your terms and how it works, do not panic as soon as its due.

– Pick a mortgage that is right for you. Do not fear ARM or adjustable mortgages simply because the economy is down, understand what you want to do with your home and make an educated choice between a fixed 30 year and an ARM. The point of a refinance is to save you money, not just lower your payment.