In our course, Exotic Car Secrets, we break down the reality behind how beneficial financing can be for exotic cars. While you may be able to afford to buy your car cash, there is no reason to let go of such a large sum when you could be borrowing free money. That right free money.

Unfortunately you won’t see ads for 0% financing on the latest Ferrari or Lamborghini. Usually dealerships will still charge you 4-6% to help get you a loan to buy one, which isn’t worth keeping your cash unless you can truly make much more than 6% on your portfolio.

There is, however, a misconception that financing exotic cars is about finding a specific lender; one that is willing. While most lenders won’t let you apply online as they don’t have all the exotic cars in their automated database, it doesn’t mean they won’t finance them.

That said, financing an exotic car is pretty simple, pain free, cheap, and can be extended in most cases to 84 months while keeping rates low. Before you ask why would you want to finance a car for 84 month, then perhaps you may want to learn from our course why that is exactly what you want to do.

The benefits are simple:

- Low payments to free up some cash flow

- Since you won’t pay any money on actually driving the car, there is no need to pay yourself in advance.

How can you get 2% financing especially on an older exotic like a 2006 Lamborghini Gallardo or 2009 Audi R8?

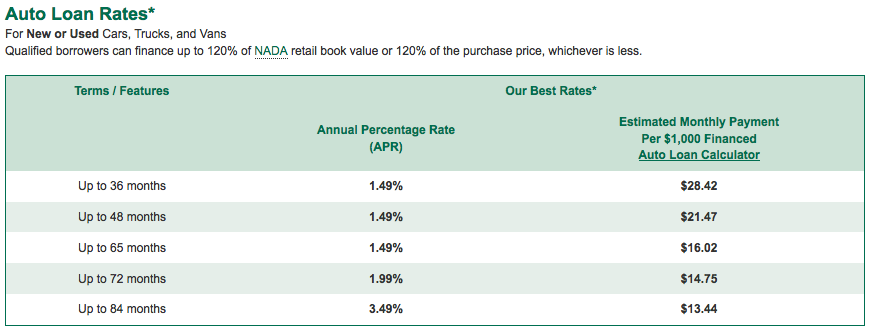

You simply have to find a credit union like PenFed that offers rates up to 84 months and rates for as low as 1.49% depending on market. You can even extend your loan once you’ve proven to be able to make payments.

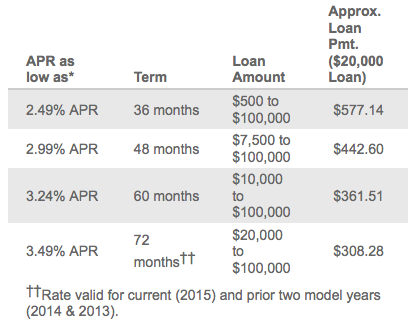

or Digital Federal Credit Union which offers digital loan products as low as 1.49% and up to 72 months.

The reality is that many credit unions will offer such rates or better and as far as 84 months, especially to credit worthy customers. All you have to really do is apply, have a credit score above 700, and then simply wait for them to give you terms of the loan which are usually lower than what you expect.

For example, they will tell you that they can only go up to 36 month on a 2006 but all you have to do is call them and speak with a supervisor in the loan department. Simply state that the car you are looking at has very low miles for its age and therefore you needed an exception for longer terms. In most cases, they will extend loans above $80,000 to 72-84 months, especially if you are using our system and buying your car at 70% of its actual market blue or black book value.

Since the bank has nothing to lose, it will usually approve the process without making it too difficult if you actually have the score and the car is the right value.

For those of you who are self-employed, be cautious that banks will want 2-3 years of tax returns and same with dealerships. The best practice for the self-employed with credit scores above the 720 range is to state that you work for an organization with a title other than CEO.

That said, you may be required to provide your latest pay stub at most rather than 3 years of tax returns. Its faster, easier, and if you are a start-up and list your net revenue in a manner that helps with your taxes, then you won’t have issues with people telling you what you can or can’t afford.

Make sure to check out Exotic Car Secrets before you buy your next car so you can save up to 80% on your purchase.