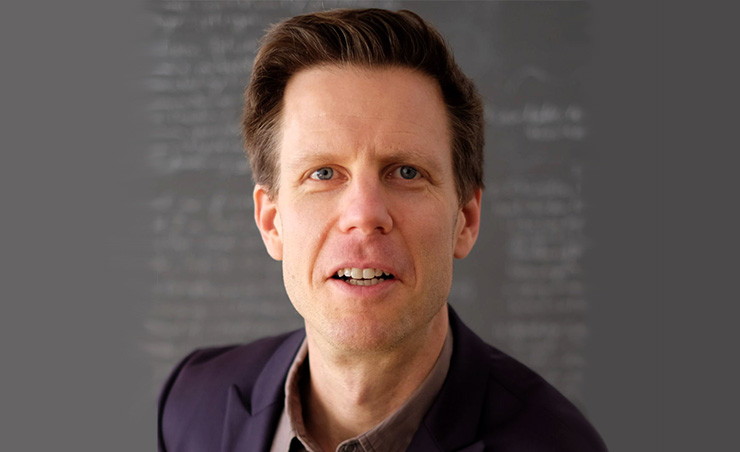

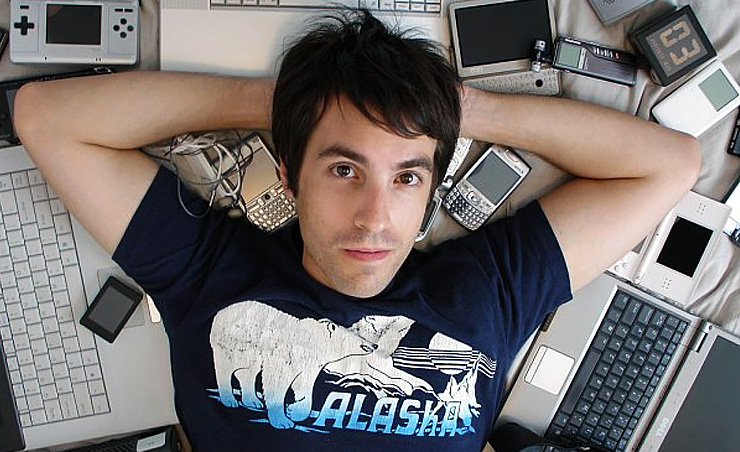

Secret Academy Episode - JD Roth

Secret Academy Episode - JD RothYou've heard the golden rule that 'cash is king' but unfortunately, we live in an age where credit cards and loans are easily accessible to the public. It should be no surprise that most citizens live their lives paying off debt ranging from student loans, to unnecessary credit card bills, and even essentials like rent or mortgages. The concept of paying off debt is quite simple but the reality is that most people spend more than they care to save. JD Roth was in the same position early in his professional career and realized his spending habits accrued to $35k in unwanted debt. Realizing the path he was going down, JD quickly made some lifestyle changes to cut his debt quickly and efficiently. While doing so, JD documented his money saving tips at a blog called GetRichSlowly.org that gained the attention of other readers in similar situations. Over the years, not only did JD pay off his debt, his blog became an authority in personal finance and grew to over 1 million visitors a month, allowing him to earn a significant amount of money each month that rivaled his previous annual salary at his day job. Three years later, Get Rich Slowly was acquired for a large sum of money by QuinStreet. Today JD spends his time teaching others financial freedom and personal finance through his Get Rich Slowly Course.

- How bad money spending habits form without you noticing

- How JD got himself in over $35,000 in consumer debt

- Resources that JD read and studied to learn about personal finance

- Why its important to be vocal and interactive in your niche online

- How Get Rich Slowly got its start and visitors early on

- Why JD opposed Google Adsense and what happened after he added it

- How you can leverage online influencers to drive traffic to your blog

- Why you should write for humans, not for search engines or SEO

- The most important thing when it comes to blogging content

- How to monetize a blog and why ads are not always the answer to monetizing

- Ways to cut down your debt with immediate lifestyle changes

- The top 3 items that lead to most debt for most consumers

- What investors look for when trying to acquire an online blog

- The process of website acquisition and things to look out for

- How much you can expect to earn through an acquisition